Fundamental Signals

You are in good company - veterans at top funds are reading.

Don't miss a key signal and start reading today!

Spotlight (Recent Development) - Organo (6368.T) - Dec 23, 2025

Dec 23, 2025

Investment, Stocks, Recent Events on Stock

Editor's Notes:

This is the stock that 10x over 5 years. Key supplier to TSMC (going where it goes - Arizona plant, Taiwan, etc.)

Stock got further attention earlier today (see our daily brief earlier).

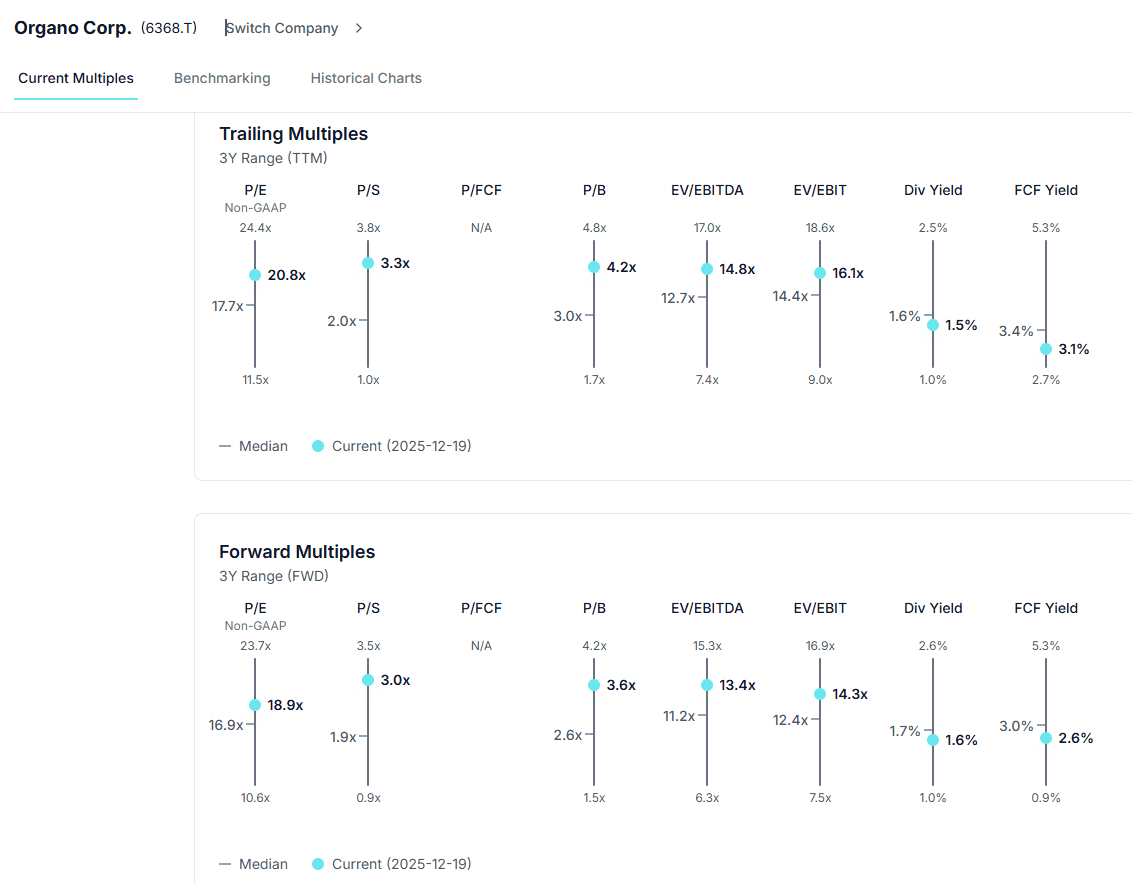

Valuation fair (not cheap) given high-single-digit annual growth at the company level and industry level. Super high quality - 18% ROE, improving margins, high barrier with good semi tail wind.

Organo Corp. (6368.T) is demonstrating strong financial performance and strategic growth, primarily fueled by the increasing demand for ultra-pure water essential in advanced semiconductor and AI chip manufacturing. Recent developments highlight significant revenue and profit increases, a revised upward full-year forecast, and a pivotal role in the rapidly expanding ultrapure water market, particularly linked to TSMC's growth.

Chronological Narrative of Key Events:

October 28, 2025: Research Nester forecasts a robust future for the global ultrapure water (UPW) market, projecting it to reach USD 28.9 billion by 2037, growing at an 8.6% Compound Annual Growth Rate (CAGR) from 2025. Organo Corporation is identified as a key participant, benefiting from increasing demand across semiconductor, pharmaceutical, and power generation sectors. The competitive landscape is intensifying, pushing Organo and its peers to invest heavily in R&D for advanced filtration technologies, expand product ranges, and form strategic alliances to enhance market position and drive growth. The consumables segment (filters, membranes, resins) is expected to capture 50.5% of the market share.

October 31, 2025: Organo Corp. releases strong financial results for the second quarter of fiscal year 2026 (April 1 to September 30, 2025). Revenue increased by 11.4% to JPY 82,793 million. Operating Profit surged by 51.4% to JPY 17,378 million, and Net Income attributable to the parent company jumped by 41.7% to JPY 11,528 million. Order intake grew 8.1% to JPY 100,281 million. Based on this performance, the company revised its full-year consolidated earnings forecast upward for FY2026, projecting JPY 175,000 million in revenue and JPY 27,000 million in net income, citing strong orders from the electronic industry, particularly advanced semiconductors related to AI, as well as robust performance in equipment services and water treatment engineering projects in Japan and Taiwan.

November 25, 2025: Market forecasts highlight specific growth within the ultrapure water sector. The global Semiconductor Manufacturing Ultrapure Water market is projected to grow from US$ 1716 million in 2024 to US$ 2901 million by 2031, exhibiting a CAGR of 7.9%. This growth is driven by the critical role of ultrapure water (resistivity >18.2 MΩ-cm, impurities as low as one part per trillion) in semiconductor manufacturing processes for cleaning, etching, and immersion lithography. Organo is a significant player in this segment.

December 12, 2025: Charlie Garcia, founder of R360 and a MarketWatch columnist, positively mentions Organo Corp. in his "Dear Charlie" column. He recommends purchasing Organo directly on the Tokyo Stock Exchange, identifying it as a "pure-play" investment closely tied to TSMC's growth and the semiconductor industry's demand for ultrapure water. Garcia also notes potential currency benefits from the yen's exchange rate. It is further revealed that Charlie Garcia personally owns shares of Organo Corp., indicating strong conviction in his recommendation.

December 21, 2025: A revised industry outlook underscores Organo Corp.'s position as a key beneficiary of the increased demand for ultra-pure water in AI chip manufacturing. The increasing complexity and shrinking size of advanced chips, critical for AI, necessitates greater quantities of ultrapure water, with each smaller chip node doubling water consumption. Organo's strong ties and leverage to TSMC's growth and new factory constructions position it as a significant, albeit less visible, investment opportunity within the AI ecosystem. This shifts Organo's primary growth drivers towards specialized ultra-pure water solutions for advanced semiconductor manufacturing, away from general industrial water treatment.

Topical Breakdown:

1. Financial Performance & Outlook

Q2 FY2026 Results (April 1 - Sept 30, 2025):

Revenue: JPY 82,793 million (+11.4% YoY)

Operating Profit: JPY 17,378 million (+51.4% YoY)

Net Income (attributable to parent): JPY 11,528 million (+41.7% YoY)

Order Intake: JPY 100,281 million (+8.1% YoY)

FY2026 Revised Full-Year Guidance:

Revenue: JPY 175,000 million

Net Income (attributable to parent): JPY 27,000 million

Key Performance Drivers: Increased orders in the electronic industry, particularly for advanced semiconductors related to AI. Strong performance in equipment-holding services, maintenance, and solution projects. Growth in water treatment engineering business (Japan and Taiwan) and functional products (small-scale pure/ultrapure water equipment, chemicals, filters).

2. Market Outlook & Growth Drivers

Overall Ultrapure Water (UPW) Market: Forecasted to reach USD 28.9 billion by 2037, with an 8.6% CAGR from 2025. Organo is a key participant.

Semiconductor Manufacturing UPW Market: Expected to grow from US$ 1716 million (2024) to US$ 2901 million (2031), a 7.9% CAGR. Organo is critical in this segment.

AI Chip Manufacturing: This is now identified as a primary growth driver. Advanced chip factories consume vast amounts of ultra-pure water (approx. 10 million gallons daily), with consumption doubling for each smaller chip node. Organo's role in providing these solutions is increasingly critical.

Key Drivers: Rising demand for UPW in semiconductor, pharmaceutical, and power generation sectors; focus on sustainability and water recycling; continuous technological advancements in filtration and purification systems.

Shift in Growth Drivers: Organo's growth is shifting from general industrial water treatment to the specific, high-growth area of ultra-pure water for advanced semiconductor manufacturing, largely tied to TSMC's expansion.

3. Competitive Landscape & Strategic Focus

The ultrapure water market is highly competitive. Organo, alongside peers like Kurita Water Industries and Nomura Micro Science, is focusing on enhancing technology, expanding product ranges, and investing in R&D for improved filtration and purification.

Strategic Alliances: Companies are forming partnerships with semiconductor and pharmaceutical manufacturers to strengthen their market position.

Implications: Increased competition and R&D expenditure may impact profitability, but successful innovation and market penetration, especially in high-growth niches like AI chip manufacturing, are expected to lead to higher profits and market share gains.

In conclusion, Organo Corp. is experiencing strong financial momentum, particularly due to its pivotal role in the rapidly expanding ultrapure water market, which is now critically intertwined with the booming AI chip manufacturing sector and major players like TSMC. This strategic positioning and technological expertise are attracting positive attention from reputable analysts.

Disclaimer: This content is generated using AI, synthesizing public data (filings, reports, news) and social media (Reddit, X). It may contain errors, inaccuracies, or hallucinations. Nothing herein constitutes financial advice. This newsletter is for informational purposes only; please consult a qualified professional and conduct your own due diligence before making any investment decisions.

You are in good company - veterans at top funds are reading.

Don't miss a key signal and start reading today!

440 N Wolfe Rd, Sunnyvale, CA 94085, United States

Copyright ©2025 Distilla, Inc. All rights reserved.