Fundamental Signals

You are in good company - veterans at top funds are reading.

Don't miss a key signal and start reading today!

Stock Spotlight - Pfizer (PFE) - Dec 30, 2025

Dec 30, 2025

Investment, Stocks, Recent Events on Stock

Editor's Notes:

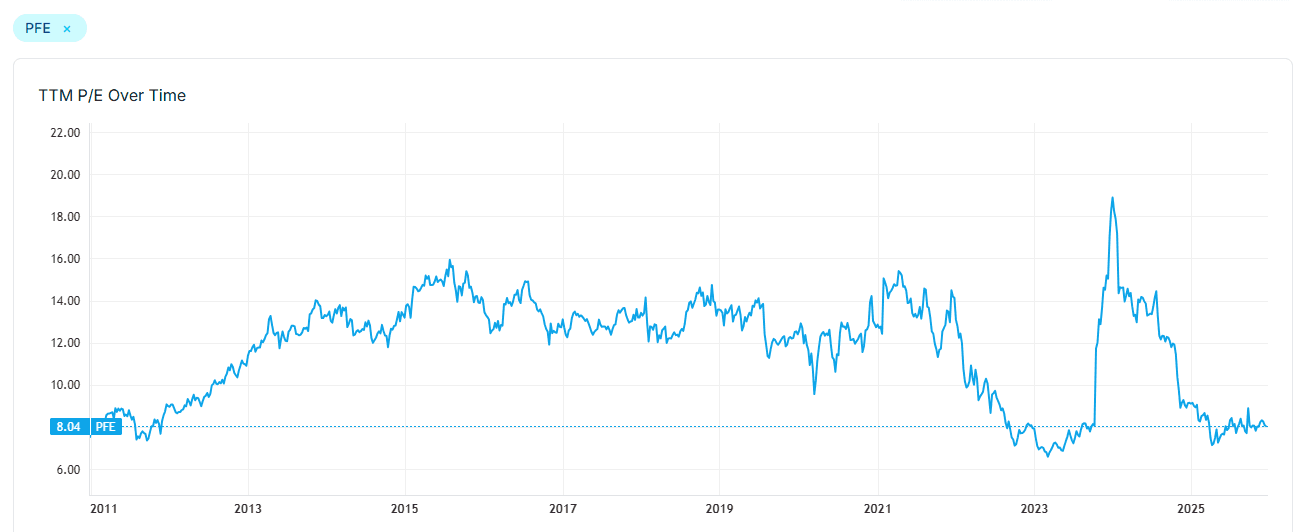

Pfizer has been a popular "fallen angel" name (8x LTM / FWD P/E and 7% dividend yield), with Michael Burry's bullish call option disclosure in Nov putting it on many people's watchlist.

The heart of the issue is the transition years of 2025-29, as management rebuild pipeline (mainly from M&As) to offset revenue decline from patent cliff / covid. The P/E today becomes less meaningful, as EPS will go down from $3.1 per share in 2025 to $2.8-3.0, and potentially $2.4 (lower rev, IRA, and R&D) before Pfizer sees growth again (likely 2029), IF successful. Let's say investors look through this, and price Pfizer at 15x 2028E P/E based on $2.4 EPS, it would be $36 per share, or 40%+ upside to the current $25 per share. The catalyst would be next year's management discussion on pipeline progress. The downside (if EPS is stuck around $2.4) is also very limited (<20%), representing a safe alpha bet in a valuation-rich market.

I can see the logic in placing a bet on this, but this is unlikely to be a multi-bagger (resumed growth after 2029 won't be super high either). It is for fundamental investors with patience, as the stock likely will be range-bound until further significant news re its pipeline certainty & potential.

Pfizer Inc. (NYSE: PFE) is strategically repositioning itself by aggressively expanding its oncology and obesity pipelines through major acquisitions and research and development (R&D), actively managing the decline of COVID-19 product revenues, and preparing for significant patent expirations. The company is implementing substantial cost-cutting measures and reiterating its commitment to shareholder returns, even as it faces complex regulatory pressures, ongoing patent litigation, and scrutiny over its dividend sustainability.

I. Financial Performance and Outlook

Recent Performance & 2025 Guidance (November 4)

Pfizer reported mixed but better-than-expected Q3 2025 earnings, with adjusted EPS of $0.87, beating consensus estimates of $0.64. Revenue reached $16.65 billion, exceeding estimates of $16.6 billion. However, this represented a 5.9% year-over-year (YoY) total revenue decline, although non-COVID products showed a 4% operational growth. Management reaffirmed its 2025 revenue guidance at $61.0-$64.0 billion and raised its adjusted EPS guidance to $3.00-$3.15. The market reaction was muted or slightly negative despite the beats, likely due to persistent concerns about declining COVID-19 product sales.

2026 Guidance and Outlook (December 16, December 25)

The company's 2026 financial guidance was generally below analyst expectations, contributing to a stock decline of 3-5% following the announcement. Pfizer projects 2026 revenue of $59.5-$62.5 billion (midpoint of $61.0 billion below consensus of $61.63 billion) and adjusted EPS of $2.80-$3.00 (below consensus of $3.05). This cautious outlook is primarily attributed to a steeper erosion of its COVID-19 franchise (projecting $1.5 billion lower revenue from COVID products in 2026 compared to 2025) and an additional $1.5 billion revenue loss from product exclusivity.

Long-Term Strategy & Efficiency

Pfizer expects a return to robust growth towards the end of the decade (2029-2030), targeting a 6% compound annual growth rate (CAGR) driven by new product launches and acquisitions. To mitigate headwinds, management is implementing a significant cost-cutting program, aiming for $7.7 billion in net cost savings by the end of 2027 ($4.5 billion by end of 2025), with a portion reinvested in R&D. The company has experienced a 26.5 percentage point decline in free cash flow margin over the last five years, indicating increased capital intensity and competition.

II. Strategic Acquisitions and Partnerships

Seagen Acquisition (2023, $43 Billion)

The 2023 acquisition of Seagen continues to be a cornerstone of Pfizer's oncology strategy, significantly bolstering its portfolio with drugs like Padcev, Adcetris, Tukysa, and Tivdak. The company aims to have eight or more blockbuster oncology medicines by 2030.

Metsera Acquisition (November 8, up to $10 Billion)

Pfizer made a decisive re-entry into the rapidly growing obesity market by acquiring Metsera for up to $10 billion ($7 billion cash upfront, up to $3 billion in milestones), winning a bidding war against Novo Nordisk. This strategic move followed the discontinuation of Pfizer's internal GLP-1 candidate, danuglipron, due to side effects (November 26). Metsera's pipeline includes promising candidates like MET-097i (GLP-1), which showed strong Phase 2 results (December 19) and is slated for Phase 3 in 2026. The acquisition is expected to be dilutive to earnings through 2030, but with projections of billions in peak annual sales from Metsera's programs.

Yao Pharma Licensing (December 9, up to $2.1 Billion)

Further solidifying its GLP-1 strategy, Pfizer entered an exclusive global licensing deal with Yao Pharma for the oral GLP-1 receptor agonist YP05002. The deal includes a $150 million upfront payment and potential milestone payments up to $1.94 billion. Pfizer is also exploring GLP-1 trials in China (December 9) and partnered with a Chinese company for GLP-1 distribution (December 27).

3SBio Licensing (PF-08634404 Cancer Drug) (December 19)

Pfizer licensed global (ex-China) rights for PF-08634404, a dual PD-1 and VEGF inhibitor, from 3SBio in a deal valued up to $6 billion (including $1.25 billion upfront ex-milestones). This asset is targeted to challenge Keytruda's dominance in oncology and is part of increased R&D investments.

Adaptive Biotechnologies Collaboration (December 15, up to $890 Million)

Pfizer expanded its collaboration with Adaptive Biotechnologies through two non-exclusive agreements focused on rheumatoid arthritis target discovery and leveraging Adaptive's TCR-antigen datasets for AI/ML-driven drug discovery, with potential milestones up to $890 million.

Other Partnerships and Investments

PADCEV/Keytruda with Astellas and Merck for bladder cancer (December 25).

VLA15 Lyme disease vaccine with Valneva (November 27).

Colorectal cancer therapy development.

PF-08046052 (solid tumors) with LAVA Therapeutics.

An equity investment in TRIANA Biomedicines for a molecular glue degrader.

Licensing Gedatolisib from Celcuity for breast cancer (December 2).

Licensing POZ polymer technology from Serina Therapeutics for LNP drug delivery (December 11).

Strategic investment and support for Cardiff Oncology's onvansertib for mCRC (December 9).

Collaboration with Oncolytics Biotech for cancer treatments (December 6).

Licensing ENHANZE® technology from Halozyme for subcutaneous drug delivery (December 4).

Partnered with Amazon on the PACT initiative, leveraging AI/ML for drug development optimization (November 30).

Acquired preclinical gene therapy products from Alexion and AstraZeneca Rare Disease (November 28).

III. Product Development and Regulatory Progress

Oncology

PADCEV + Keytruda (Bladder Cancer): Received positive Phase 3 results (EV-304/KEYNOTE-B15) and FDA approval (November 21) for muscle-invasive bladder cancer (MIBC), positioning it as a potential new standard of care with multibillion-dollar peak sales expected.

TUKYSA (Breast Cancer): Positive Phase 3 HER2CLIMB-05 results (December 9) for HER2-positive metastatic breast cancer, showing a 35.9% reduction in disease progression or death risk as first-line maintenance treatment.

Vepdegestrant (Breast Cancer): Advanced into late-stage development (December 24). FDA set a PDUFA date of June 5, 2026, and granted Fast Track designation (November 24).

PF-08634404 (Cancer): Investigational cancer medicine with 7 Phase 3 studies launching soon and 10 more by end of 2026, aiming to challenge Keytruda.

Obesity/Weight Management

MET-097i (Metsera acquisition): Showed promising Phase 2 results (December 19) with substantial weight loss, fewer side effects, and long-acting dosing. Phase 3 trials are planned for 2026.

YP05002 (Yao Pharma licensing): An oral GLP-1 receptor agonist in Phase 1 development (December 9).

Other Key Products

Hympavzi (Hemophilia A/B): Received FDA approval (December 23). However, a patient death in a long-term extension study (cerebellar infarction and cerebral hemorrhage) is under investigation, leading to reassessment of surgical management protocols (December 23).

mRNA Flu Vaccine: Showed superior efficacy in Phase 3 study (November 20), with regulatory submissions expected in 2026. This is a key initiative to replace declining COVID vaccine revenue.

VLA15 (Lyme Disease Vaccine): Co-developed with Valneva, positive mid-stage data (November 27). Phase 3 vaccinations are complete, with results expected in H1 2026 and regulatory submissions planned for 2026.

25-valent pneumococcal program: The pivotal trial has been delayed (November 11) due to ongoing collaboration and alignment with the FDA.

Depo-Provera: FDA approved a label change (December 17) to include a meningioma risk warning, amid ongoing lawsuits.

IV. Regulatory and Political Landscape

US Drug Pricing & Inflation Reduction Act (IRA)

The Centers for Medicare & Medicaid Services (CMS) is targeting Pfizer medicines for price cuts under the IRA. Specifically, Ibrance faces a 40-50% price reduction by 2027 (November 26), and other undisclosed drugs are also subject to discounts (November 26).

Pfizer reached a deal with the Trump administration (October, November 19) to lower prescription drug prices for some US patients (e.g., Medicaid) in exchange for a three-year exemption from pharmaceutical import tariffs and a commitment to $70 billion in US R&D and manufacturing investments. CEO Albert Bourla acknowledged the unsustainability of current US drug pricing discrepancies.

International Trade & Market Access

A US-UK trade deal (December 9) is expected to positively impact Pfizer, with the UK increasing drug prices and the US exempting UK-origin pharmaceuticals from import tariffs for three years.

Pfizer's cancer treatments have been approved for inclusion in China's first commercial health insurance drug catalog (December 8), allowing for potentially better pricing than under state insurance. Pfizer is also initiating weight loss drug trials in China.

COVID-19 Vaccine Scrutiny

The FDA expanded its safety inquiry into COVID-19 vaccines (November 29), considering a boxed warning and implementing stricter approval standards due to potential links to child deaths and myocarditis concerns. The FDA also added myocarditis/pericarditis risks to the vaccine label (December 1). These developments negatively impact sales and future approvals for the vaccine segment. Comirnaty sales declined 20% in Q3 2025.

V. Dividend and Shareholder Value

Dividend Declaration (December 12)

Pfizer declared a Q1 2026 cash dividend of $0.43 per share, marking its 349th consecutive quarterly payment.

Dividend Profile and Concerns

Pfizer maintains a history of 16 consecutive years of annual dividend increases, offering a current forward yield of 6.5-7%. However, dividend growth has slowed to 2.4% annually from a historical 6.9% (December 10). There are significant concerns about dividend sustainability due to a currently high payout ratio (near 100% or over), impending patent expirations for key drugs like Ibrance, Eliquis, and Vyndaqel (2027-2028), and a historical precedent of dividend cuts after major acquisitions (e.g., Wyeth in 2009). The Metsera acquisition adds to the financial pressure.

Management Commitment & Capital Allocation

Management has reiterated its commitment to maintaining and growing the dividend over time, with the significant cost savings program ($7.7 billion by 2027) aimed at supporting this. However, the company is prioritizing investment in development programs over share repurchases for 2025 (December 16).

Shareholder Activity

Michael Burry's Scion Asset Management disclosed call options on Pfizer in Q3, indicating a bullish position (November 4). Prem Watsa's Trades, Portfolio increased his stake by 36.87% (240,000 shares) in Q3 (November 14). Conversely, activist investor Starboard Value, which previously launched a campaign against Pfizer, began divesting its stake in May 2025, selling 8.5 million shares in Q3 (November 13).

VI. Legal and Other

Depo-Provera Lawsuits (December 17)

Pfizer is facing over 1,000 lawsuits regarding its Depo-Provera contraceptive injection, alleging failure to warn about meningioma risk. This coincides with the FDA's recent approval of a label change to include this warning.

Patent Litigation (mRNA COVID-19 Vaccines)

The US Moderna litigation against Pfizer/BioNTech for mRNA technology is scheduled for a jury trial in March 2026 (December 11). Separately, Pfizer/BioNTech settled US patent disputes with CureVac (August 2025, benefiting CureVac by $370 million), but litigation continues in other global jurisdictions. Arbutus Biopharma also had a favorable claim construction ruling in September 2025 for its LNP patent litigation against Pfizer/BioNTech (November 13).

Texas Quillivant XR Settlement (November 17)

Pfizer and Tris Pharma settled a lawsuit with the state of Texas for $41.5 million over allegations of supplying adulterated ADHD medication to Medicaid patients.

Management Changes

Dr. Kathy Fernando (SVP, Global Head Pfizer Ignite) and Dr. Greg Di Russo (Development Head, Non-Malignant Hematology) have departed Pfizer for other roles (December 16, December 1).

AI Integration

CEO Albert Bourla emphasized Pfizer's active integration of Artificial Intelligence (AI) into drug discovery and development, aiming to accelerate clinical trials and drug design (November 13).

Analyst Ratings and Price Targets (as of late December)

Scotiabank: Reiterates Buy, $30 PT (December 30).

CMB International: Initiates Buy, $36.16 PT (November 10).

Guggenheim: Raises PT to $35 from $33, Maintains Buy (November 28).

Jefferies: Maintains Buy, $33 PT (December 2).

Morgan Stanley: Maintains Equal-Weight, lowers PT to $28 from $32 (December 17).

Bank of America: Maintains Neutral, lowers PT to $27 from $28 (December 25).

Wolfe Research: Lowers PT to $24 from $25, citing dividend concerns (December 17).

Bernstein: Reiterates Hold (December 11).

TD Cowen: Maintains Hold, $30 PT (November 12).

Citigroup: Reiterates Neutral, $26 PT (December 3).

Overall Sentiment: Pfizer is actively working to transition from its COVID-driven growth era and mitigate the impact of upcoming patent expirations. The company's aggressive M&A strategy, particularly in oncology and obesity, alongside significant R&D investments and cost-cutting measures, indicates a focused effort to rebuild its pipeline and ensure long-term growth. However, concerns persist regarding the sustainability of its dividend, the dilutive impact of acquisitions, and the challenging regulatory and competitive environment, especially for its vaccine franchise and patented drugs. The market appears to be in a "wait-and-see" mode, with stock performance reflecting cautious investor sentiment despite positive clinical trial results and strategic advancements.

Disclaimer: This content is generated using AI, synthesizing public data (filings, reports, news) and social media (Reddit, X). It may contain errors, inaccuracies, or hallucinations. Nothing herein constitutes financial advice. This newsletter is for informational purposes only; please consult a qualified professional and conduct your own due diligence before making any investment decisions.

You are in good company - veterans at top funds are reading.

Don't miss a key signal and start reading today!

440 N Wolfe Rd, Sunnyvale, CA 94085, United States

Copyright ©2025 Distilla, Inc. All rights reserved.