Fundamental Signals

You are in good company - veterans at top funds are reading.

Don't miss a key signal and start reading today!

Profile - Komatsu (6301.T) - Jan 06, 2026

Jan 7, 2026

Investment, Stocks, Views on Stock

Editor's Notes

Upcycle for metals & mining and industrial capex for supply chain migration can be beneficial tailwind for Komatsu.

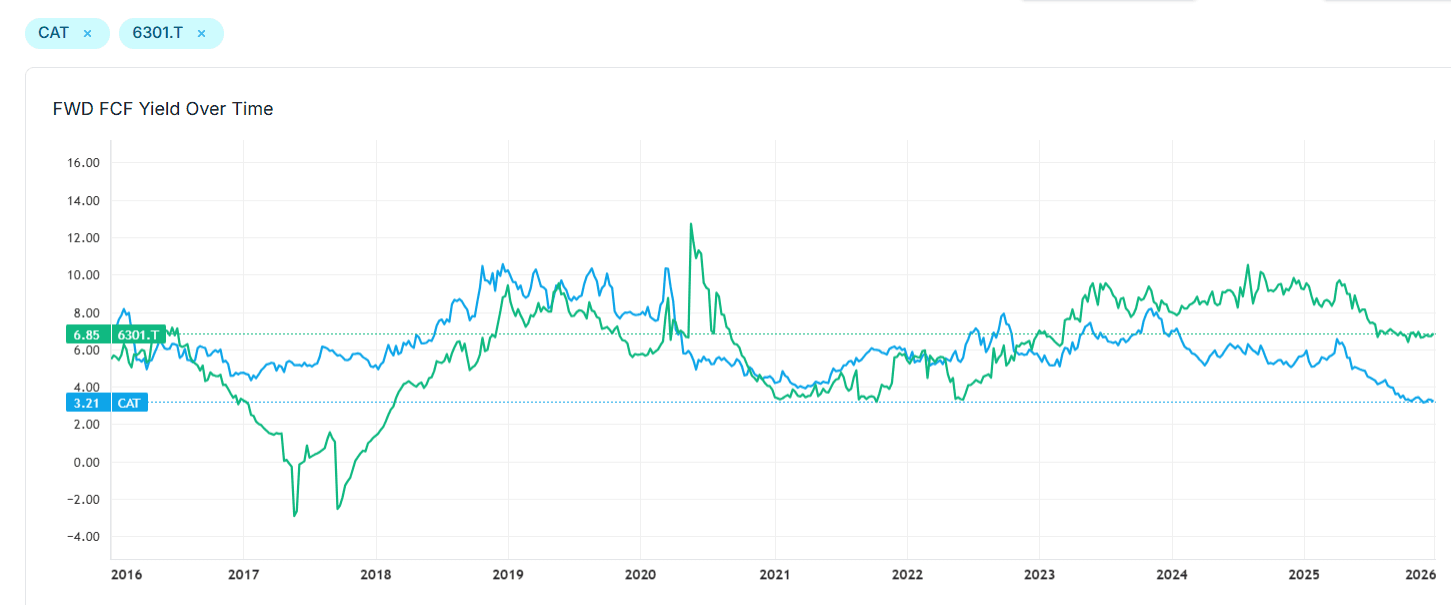

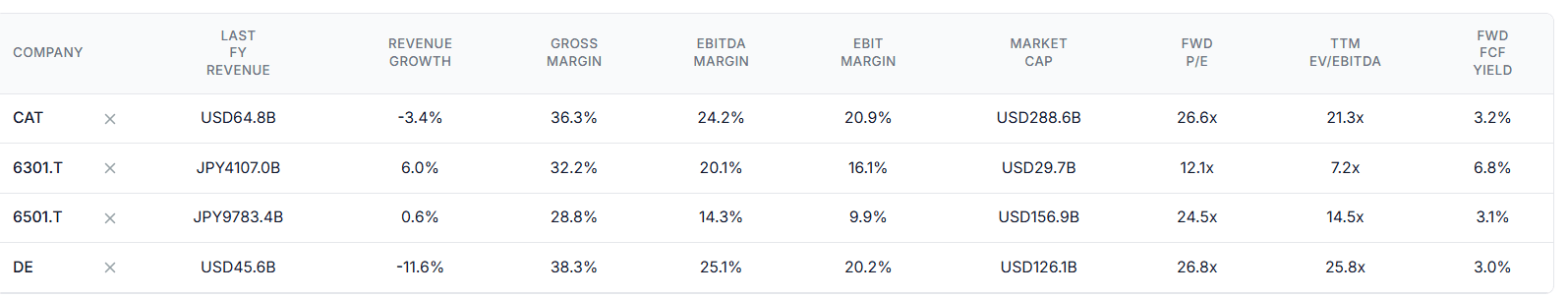

Komatsu trades at a significant discount to CAT (peak valuation level), Deere, and Hitachi, with ~7% FCF yield, around 3-year mid point. While tariff impacts, regional exposure and competitive positioning (CAT is a clear #1 with US & tech tailwind, Sany gaining share given China & cost advantage) may make Komatsu less appealing, the big discount is likely not justified.

While appearing reasonably priced, I would monitor market share dynamics and any regional trends closely, given competitive pressure from China (e.g. Sany saw double-digit top line growth in 1H25 vs. decline for Komatsu) and prolonged regional geopolitics / protectionism uncertainty. My personal philosophy is to be super careful when investing into #2 / #3 when it is losing market share, even if cheap. That said, if deeper channel checks indicates sustainable edge / turnaround for Komatsu, this may be a good entry point.

Komatsu Ltd. is a global leader in manufacturing construction, mining, and industrial equipment, distinguished by its technological leadership in ICT integration and automation, and an extensive global distribution network. While demonstrating consistent annual growth and strategic investment in advanced technologies like hybrid powertrains and autonomous systems, Komatsu faces significant near-term challenges from macroeconomic headwinds, currency fluctuations, and US tariffs, which have impacted recent quarterly performance and revised financial guidance.

Komatsu Ltd.: Company Overview and Strategic Position

Komatsu's Revenue Breakdown (H1 FY2026 - April 1 to September 30, 2025)

Segment | % of Sales | Trend/Growth Driver |

|---|---|---|

Construction Equipment & Vehicles | 91.2% | Decreased by 4.8% YoY (Yen appreciation, reduced sales volume). ICT ratio at 27.0%. |

Industrial Machinery & Others | 5.6% | Increased by 10.5% YoY (Higher sales of large presses for auto, excimer laser maintenance). |

Retail Finance | 3.2% | Decreased by 1.3% YoY (Yen appreciation offset by interest income), profit up 13.9% (lower funding costs). |

Diversified revenue across all markets - North America is the largest region (~25%), followed by LatAm (17%), Asia excl. Japan & China (11%), Oceania (11%), Europe (9%), Japan (8%), Africa (6%), Middle-East (3%), China (2%), with China and North America experiencing sharp decline recently (mid to high teens)

Industry Context

Competitive Landscape & Industry Trends

Komatsu operates in dynamic markets, facing intense competition while benefiting from significant industry growth drivers.

Competitive Pressures

Rival Investments: Komatsu faces increased competitive pressure from rivals like Caterpillar, Deere, and Hitachi investing heavily in electric, autonomous, and connected equipment.

Chinese Manufacturers: Faces intensified competition from the global expansion of Chinese manufacturers like Sany Heavy Industry.

Used Equipment Market: Growth in the second-hand excavator market provides a cost-effective alternative to new sales, though Komatsu's strong brand and service network help (November 2025). Southeast Asia's used construction equipment market is particularly impacted by cost-effective Chinese brands.

Key Trends & Drivers

Electrification & Decarbonization: Strong industry shift towards sustainable, fuel-efficient, and electric vehicles (dump trucks, excavators, forklifts). Driven by stricter emissions regulations (Stage V, Tier 5), sustainability mandates, and ESG investment trends.

Automation & AI: Increasing adoption of automation, machine learning, and AI across mining (robotics, autonomous haulage, mine scalers, continuous miners) and construction (Smart Construction, autonomous dozers, robotic deconstruction, AI-driven cranes). Driven by safety demands, labor shortages, and efficiency needs.

Digitalization & Telematics: Widespread integration of IoT, telematics, and digital twin technology for asset monitoring, predictive maintenance, and fleet management (e.g., KOMTRAX enhancement, Smart Construction, OEM telematics market).

Infrastructure Development: Global infrastructure projects, urbanization, and smart city initiatives continue to drive demand across various equipment markets (earthmoving, road construction, cranes, long-span bridge erection).

Global Resource Demand: Increased demand for minerals, metals, and rare earth elements fuels the mining equipment market.

Komatsu's Key Strategic Priorities and Market Development Efforts

Priority 1: Technological Leadership & Digital Transformation: The company is heavily investing in and deploying advanced technologies such as ICT construction machines and Autonomous Haulage Systems (AHS), with 940 units deployed. Komatsu is also developing software-defined vehicle (SDV) architectures and forming strategic partnerships, such as with Cummins for hybrid powertrains. These initiatives aim to drive decarbonization, enhance efficiency, and differentiate products, especially in critical sectors like mining.

Priority 2: Operational Efficiency & Strategic Pricing: Management prioritizes offsetting rising material, logistics, and fixed costs through rigorous cost reduction programs and proactive selling price adjustments. This strategy is crucial for sustaining and improving profitability amidst inflationary pressures and fluctuating currency values.

Priority 3: Market Diversification & Global Reach: Komatsu is expanding its product portfolio into strategic areas like forestry machinery and semiconductor manufacturing equipment. It is also strengthening its Hard Rock mining business. A robust global distribution and service network supports market penetration and generates significant aftermarket revenue streams, as demonstrated by involvement in projects like Reko Diq in Pakistan.

New Initiatives in Emerging Markets

Kazakhstan (December 2025): Komatsu is strengthening its partnership with Kazakhstan, planning a production complex in Astana for equipment repair and restoration (to be the largest regional hub in Central Asia) and establishing a regional training center.

Turkmenistan (December 2025): Komatsu met with President Berdimuhamedov to explore future investment projects in areas like water/waste management, green energy, and the circular economy.

Bengaluru, India (December 2025): Leased 21,000 sq ft of office space to establish a Global Capability Centre, part of a broader trend of Japanese firms expanding in India.

Elliot Lake to Sudbury Relocation (November 2025): Komatsu permanently closed its Elliot Lake mining operation (affecting 45 employees) and relocated to Sudbury to centralize and strengthen its underground hard rock business.

Chile (October 2025): Opening new job vacancies in various regions, indicating hiring plans.

Key Customer Wins

Barrick Gold (December 2025): Secured a $440 million deal to supply mining equipment for the Reko Diq project, mostly US-manufactured.

G Mining Ventures (October/December 2025): Selected as a major supplier for the Oko West Gold Project, with the first mining shovel scheduled for commissioning in Q4 2025.

Lindian Resources (December 2025): Supplying a mining fleet (haul trucks, loaders, dozers) for the Kangankunde rare earths project.

North American Construction Group (December 2025): Sold eight 240-ton haul trucks for Australian operations.

Strategic Partnerships

Cummins Inc. (November 2025): Collaborating on hybrid powertrains for heavy mining equipment (MOU signed).

General Motors (December 2025): Collaborating on hydrogen fuel cell module for mining trucks.

Applied Intuition (September 2025): Collaborating to develop next-generation intelligent, software-driven vehicles for mining and construction, and for simulation and automation in mining operations.

Engcon (December 2025): Strengthening collaboration to integrate Engcon's DC3 tiltrotators with Komatsu's Machine Control 3.0 for Komatsu Dash 12 series, available January 2026.

Japanese Contractors (October 2025): Partnered for deployment of fuel-efficient loaders with IoT-enabled fleet management for infrastructure projects.

Komatsu Ltd. Financial Performance: Trends and Recent Momentum

Annual Financial Trends (Fiscal Year ending March 31)

Metric | FY2022 (ends Mar 2023) | FY2023 (ends Mar 2024) | FY2024 (ends Mar 2025) | Commentary |

|---|---|---|---|---|

Revenue (JPY Million) | 3,555,566 | 3,873,171 | 4,107,045 | Komatsu has shown consistent revenue growth, achieving a Compound Annual Growth Rate (CAGR) of 7.5% over the two-year period. |

Op. Margin (%) | 14.23% | 15.79% | 16.15% | The company has demonstrated steady expansion in its operating margins, reflecting improved efficiency. |

ROIC (%) | 11.14% | 11.47% | 11.83% | Return on Invested Capital (ROIC) has seen gradual improvement, indicating better capital efficiency. |

FCF (JPY Million) | 22,941 | 231,831 | 311,312 | Komatsu has achieved a significant increase in free cash flow generation, bolstering its financial strength. |

Komatsu's Recent Quarterly Financial Momentum (JPY Million, % for Margins/Growth)

Metric | Q3 FY2025 (ends Dec 2024) | Q4 FY2025 (ends Mar 2025) | Q1 FY2026 (ends Jun 2025) | Q2 FY2026 (ends Sep 2025) |

|---|---|---|---|---|

Revenue (JPY Million) | 989,196 | 1,147,133 | 909,524 | 982,063 |

Rev Growth (YoY) | N/A | 7.13% | -5.24% | -2.59% |

Gross Margin (%) | 33.16% | 31.79% | 32.71% | 31.18% |

Operating Margin (%) | 16.55% | 17.08% | 15.39% | 14.02% |

Beat / Miss:

The company reported disappointing Q1 and Q2 2025 earnings (for quarters ending July 29th), missing revenue and EPS consensus estimates.

For Q1, revenue was $6.12 billion (vs. $6.49 billion consensus), and EPS was $0.69 (vs. $0.74 consensus).

Q2 showed similar results, with revenue of $6.45 billion (below $6.56 billion consensus) and EPS of $0.63 (meeting consensus).

Overall, H1 FY2026 saw net sales decline by 3.9% and net income by 12.9% year-over-year.

October 30, 2025: Komatsu stock fell 5.03% following Q2 FY2026 results, which reported a 7% YoY operating profit decline (missing guidance) and lower sales volumes, particularly in Asia. Reduced demand forecasts prompted revised FY2026 guidance in USD terms, reflecting significant negative impacts from US tariffs and yen appreciation.

October 29, 2025: The stock decreased by 4.23% after revised FY2026 revenue estimates were lowered in USD terms. US tariffs on semiconductor components and lithium-ion batteries negatively impacted autonomous truck production costs and overall profitability.

FY2026 Estimates: Revenue estimates for full-year 2026 have been decreased from $3,984.24 billion to $3,936.25 billion.

Balance Sheet: Komatsu maintains robust liquidity with Cash & Short-Term Investments totaling JPY 345,199 Million as of Q2 FY2026 (September 30, 2025), although this is a decrease from JPY 448,891 Million in Q1 FY2026.

Valuation Context

NTM P/E: Current valuation stands at 12.1x, within its 3-year range of 8.2x to 13.3x.

NTM EV/EBITDA: Current valuation is 7.1x, falling within its 3-year range of 5.0x to 7.9x.

What are the Key Risks and Debates for Komatsu Ltd.?

Market Controversy: A central debate for Komatsu revolves around its capacity to maintain profitability and navigate a complex global economic environment. This includes managing potential economic slowdowns, currency volatility, and increasing trade protectionism, such as US tariffs. Investors are evaluating how well Komatsu's technology-driven competitive advantages can withstand these macroeconomic headwinds and intense market competition.

Top Risks:

Macroeconomic Headwinds & Geopolitical Impact: Global economic slowdowns, persistent high interest rates, and a sluggish real estate market in China could reduce demand for construction and mining equipment. US tariffs are a material concern, projected to decrease operating profit.

Currency Exchange Rate Fluctuations: An appreciation of the Japanese Yen can significantly diminish overseas earnings and reduce export competitiveness, as recently observed in Komatsu's performance.

Intense Competition & Cost Pressures: Aggressive pricing strategies from competitors and ongoing increases in procurement and logistics costs may pressure margins. This necessitates effective cost management and strategic pricing initiatives.

Tariff Impact & Mitigation

The company anticipates an annual negative impact of 90 billion yen (approx. $0.58 billion) from increased costs due to U.S. tariffs, primarily on products imported from Japan and China.

This is expected to result in a 55 billion yen ($0.35 billion) hit to profit and loss after cost reductions.

Komatsu plans to implement price hikes to mitigate these effects and is banking on rising demand in the mining sector.

Disclaimer: This content is generated using AI, synthesizing public data (filings, reports, news) and social media (Reddit, X). It may contain errors, inaccuracies, or hallucinations. Nothing herein constitutes financial advice. This newsletter is for informational purposes only; please consult a qualified professional and conduct your own due diligence before making any investment decisions.

You are in good company - veterans at top funds are reading.

Don't miss a key signal and start reading today!

440 N Wolfe Rd, Sunnyvale, CA 94085, United States

Copyright ©2025 Distilla, Inc. All rights reserved.